OCBC Digital Banking

Regional localisation and product experience design

Background and role

Multi-faceted contributions to the bank’s digital transformation efforts — from leading regional localisation to designing integrated partner solutions and supporting visual design across squads.

Lead designers for localisation and partner solution projects, visuals supports at times.

Hong Kong Localisation

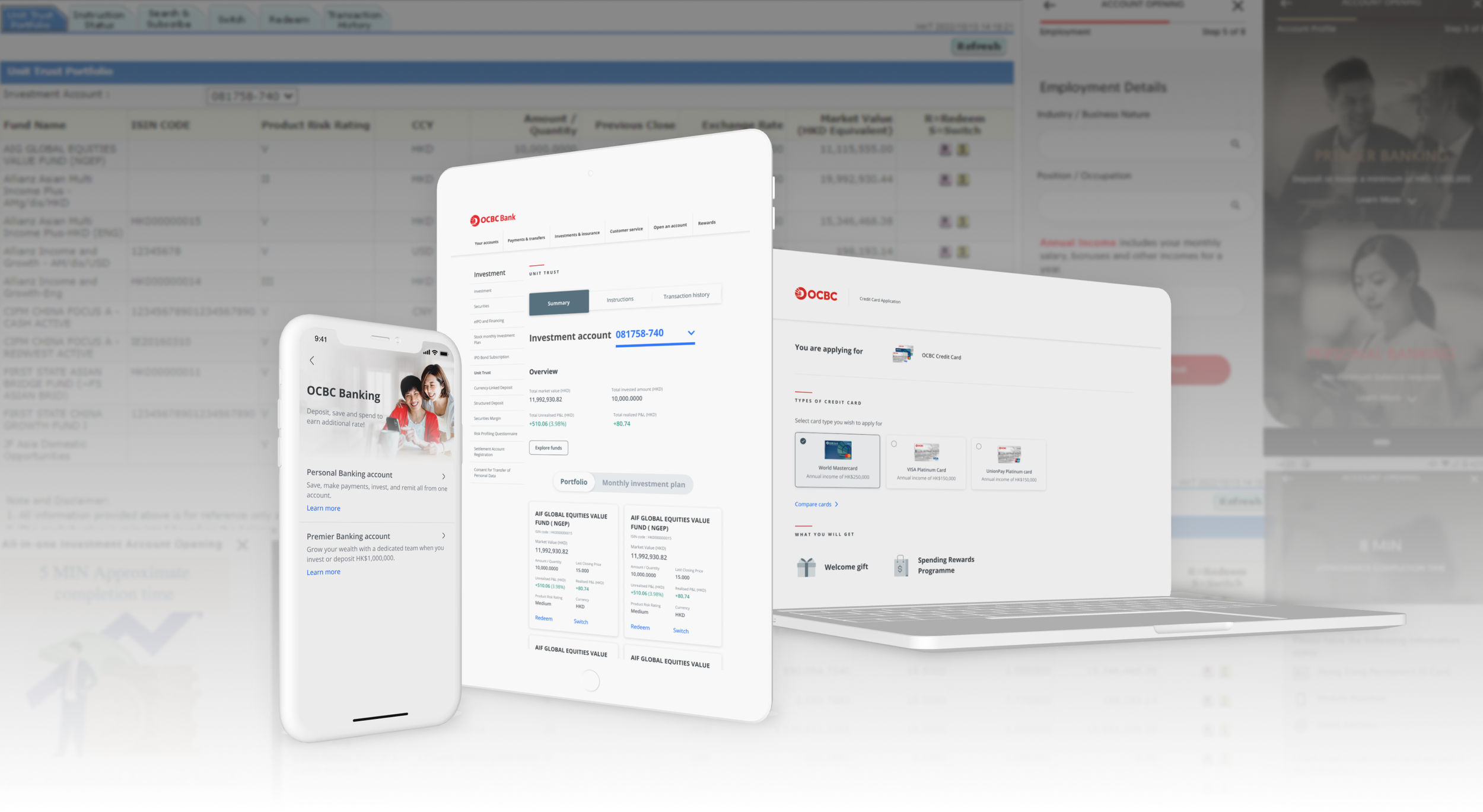

As part of OCBC’s regional digital expansion, the bank aimed to streamline digital product experiences across markets using a unified Design Language System (DLS). Leading this localization initiative, this stream of work focused on localising key Hong Kong banking products while preserving Singapore’s scalable logic and design consistency. Key products across various platforms of dotcom, Internet banking as well as mobile banking: Investment account opening, Offshore Account opening, Credit card application and Unsecured loan application.

Approach

Mapped HK product differences against Singapore's eligibility-first platform logic to create consistent cross-market experiences. Restructured user flows with upfront qualification screening, value proposition landing pages, and preparation guidance to reduce mid-journey abandonment and filter for qualified applicants.

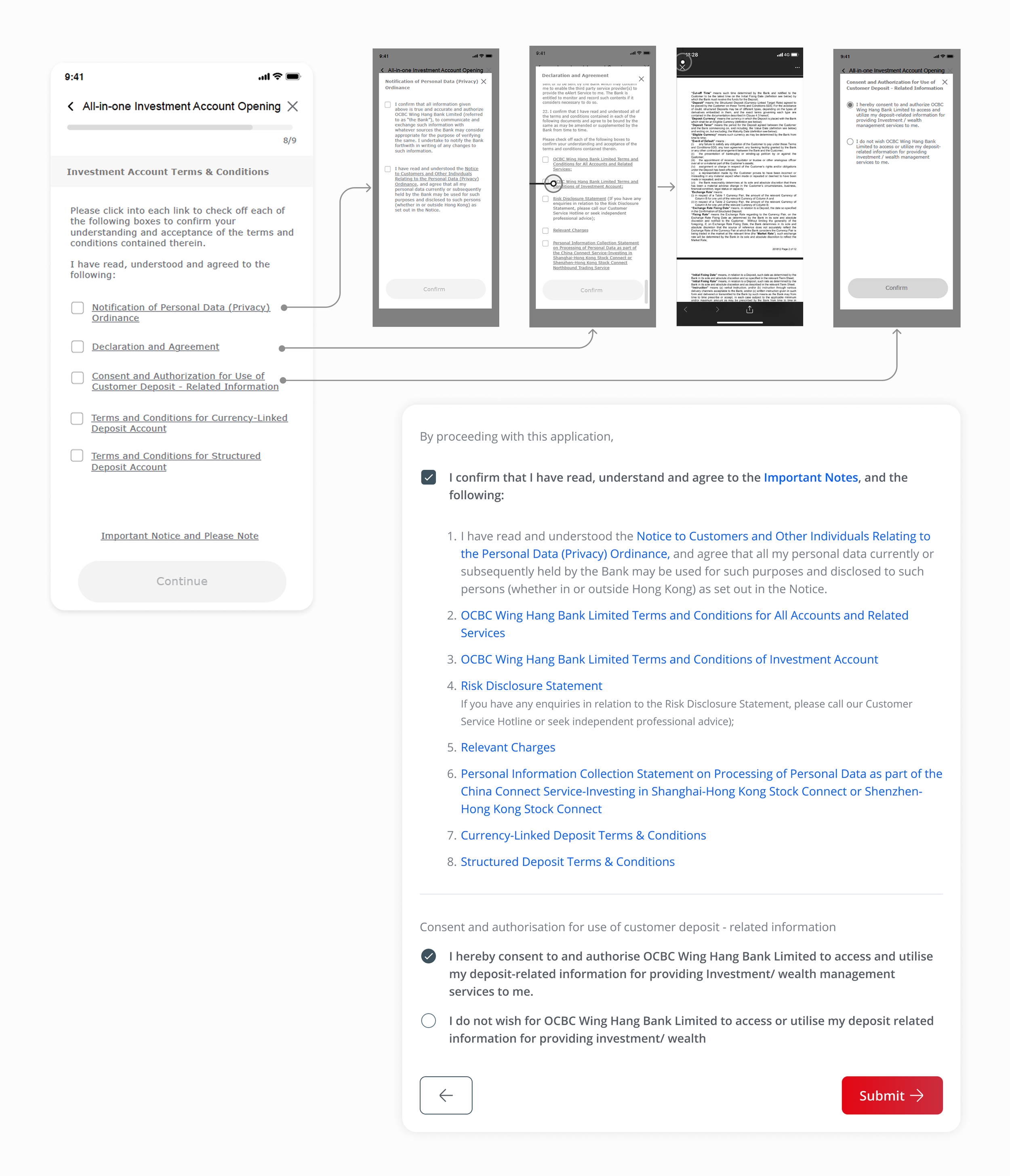

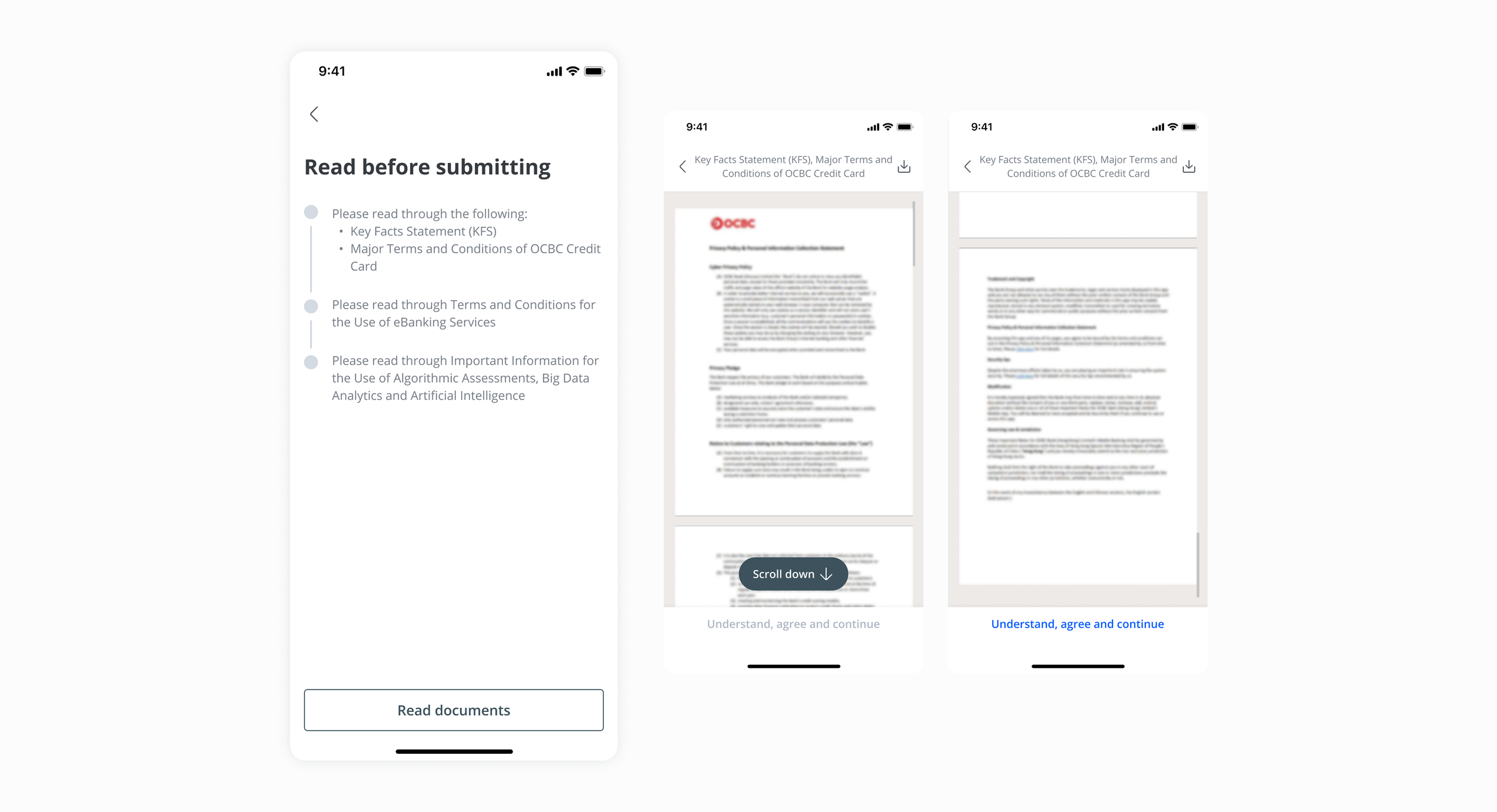

Compliance handling

Consolidated HK's fragmented legal disclaimers and complex nested T&Cs into a streamlined single-entry acknowledgment flow, reducing user friction while maintaining full regulatory compliance.

Visual design alignment

Cross-platform unification aligned disparate visual experiences across mobile banking, dotcom, and internet banking platforms into a cohesive look and feel, ensuring consistent user experience regardless of access point. For example: Funds were previously displayed in a table format, with each fund represented in a row. With the adoption of the updated design library, the layout was shifted to individual card views, which improve readability and scanability. In this new format, action elements are placed near key fund information for easy access, whereas in the table format, users had to navigate to the end of each row to perform actions.

Buy Now Pay Later Integration

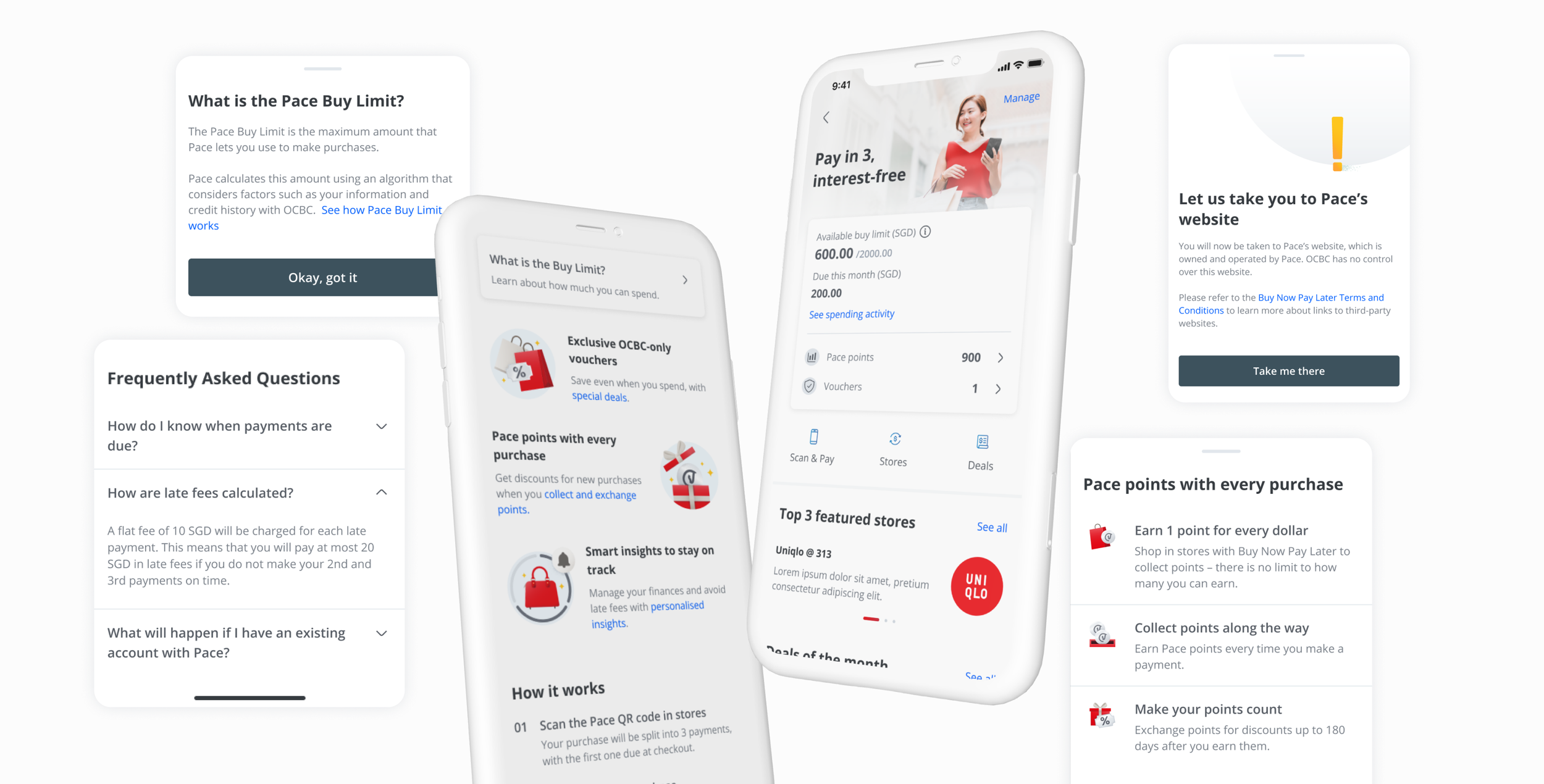

Using CX process mapping as foundation, led comprehensive design execution through final delivery phase, delivering flexible, context-aware BNPL integration for a banking app that created seamless cross-platform ( Bank to third-party) user journeys while maintaining trust and clarity. The project is a demonstration of complete design lifecycle execution, although the launch didn't happen due to the closure of third party provider.

User-centeric content strategy

Structured information hierarchy prioritising user decision-making needs. Lab tests revealed the need for clarity on buy-limits, late fees, and pace points for the customer. We implemented multiple access points to critical information.

Design for third party integration

Created contextual messaging and visual continuity with clear pathways to manage customer's expectations after the account is created, thus maintaining user confidence during third party transition.

QR scanning flow for different customers state

Assuming new customers primarily discover the product through QR scanning, we implemented dynamic user state detection for personalised onboarding, embedding account creation within purchase flows through progressive profiling to minimise abandonment.when transaction circumstances change.

Purchase status management

Designed adaptive status tracking catering to real-world scenarios where purchase returns are increasingly common, ensuring clear communication and automatic payment plan adjustments when transaction circumstances change.

Visual design

Illustration Development

Contributed to illustration development and styling exploration when client required visual changes, exploring and adjusting visual style directions for graphics across different sizes while maintaining DLS consistency.

Design System Evolution

Ensured new visuals felt cohesive across the entire app experience by adapting illustrations to the evolving Design Language System standards and requirements.

Digital campaign key visual

Develop art direction and execute key visual elements for OCBC's marketing campaign, including assets for the marketing website and related promotional materials.

Core strengths demonstrated

Team leadership and knowledge sharing

Led stakeholder education on design standards and banking logic across different projects, helping bridge technical, business, and design needs while sharing knowledge between Singapore and Hong Kong teams.

Systematic design and flexibility

Built consistent design approaches that work across different platforms, markets, and integrations - from creating unified visual experiences to handling complex situations like partial refunds and third-party connections.

End-to-End project management

Managed projects from start to finish, leading the complete design process from wireframes to final visuals while adapting product approaches across different regions and maintaining quality throughout.